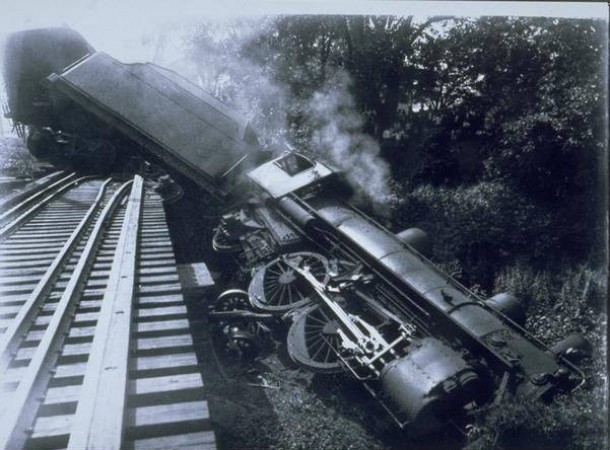

Bad things can happen to good people. We work hard, do the right things, and yet things can happen that can ruin everything. Sometimes it’s not our fault, and sometimes it is, but all the same a single mistake can take everything you have. A few things that can destroy everything you have been working for, and leave you and your family with nothing:

Bad things can happen to good people. We work hard, do the right things, and yet things can happen that can ruin everything. Sometimes it’s not our fault, and sometimes it is, but all the same a single mistake can take everything you have. A few things that can destroy everything you have been working for, and leave you and your family with nothing:

- Simple business transactions that have been entered into time and time again without problem can become disaster due to unexpected changed conditions outside our control.

- Errors in judgment regarding simple matters that seem unimportant at the time.

- Business partners that turn out to be untrustworthy.

- Mistakes committed by family and/or friends (or perhaps even by yourself).

- Family problems.

- Driving an automobile (even when you are insured and “protected”).

- Business transactions with trusted friends executed with a handshake.

- Just plain bad luck.

I have found that very smart people often don’t like thinking about what can go wrong. This is a big mistake. It is very important that you review the possible risks you face in your personal and business life. It is important that you be realistic about these risks. What are some of the “worst-case” scenarios that could happen to you?

Once this is done it is possible to determine what you need to do in order to protect your assets and insure that you and your family are protected. Not everyone is the same. Not everyone needs the same level of protection. It is for this reason that I created the Wealth Preservation Fortress®. It is modular system so that each person receives the customized care he or she needs and the protection he or she deserves without having to reinvent the wheel each and every time.

If you have any questions please do not hesitate to contact me, or you can simply request a copy of my free ebook “Building Your Wealth Preservation Fortress®.